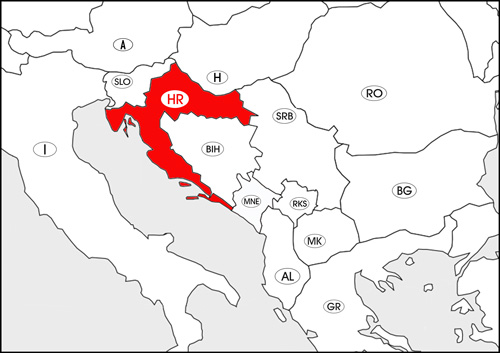

Situated in the heart of Europe, only two or three hours flight distance to any European destination, Croatia, with its highly developed road and railway network, and the network of seaports, inland ports and airports, as well as inland waterways and intermodal terminals, represents the central link between Europe and the world. The network of modern motorways, placing Croatia together with leading European countries, provides a possibility of fast and uninterrupted travel. International transport corridors pass through Croatia, the country is 100% digitized, with its entire territory covered by broadband Internet. Its highly developed gas distribution network places it at the very top of European countries. All of this makes Croatia an ideal transport, communication and energy intermediary, not only among countries in the region, but between the Mediterranean and the rest of the world.

The Republic of Croatia has been a full member of the European Union since 1st July 2013, with all the rights and obligations arising from said membership. With the EU membership, Croatia became part of a single internal market and a customs union. The internal market is characterized by the free movement of goods, services, capital and labour, and a common trade policy and agricultural policy. In the European Single Market, which is made up of 27 Member States, goods, services, capital and people can move freely, as within a single country, without obstacles represented by state borders. The Customs Union is characterized by common customs regulations and free trade between the EU Member States.

MOTIVE NO. 1: CLEAR LEGAL FRAMEWORK INCENTIVE FOR FOREIGN INVESTORS

MOTIVE NO. 2: CUSTOMS SYSTEM

MOTIVE NO. 3: ENTREPRENEURIAL ZONES

MOTIVE NO. 4: TAX RELIEF

MOTIVE NO. 5: INSTRUMENTS FOR PROTECTION OF FOREIGN INVESTMENTS

MOTIVE NO. 6: DOUBLE TAXATION AVOIDANCE AGREEMENTS

MOTIVE NO. 7: FREE TRADE AGREEMENTS

MOTIVE NO. 8: AGREEMENTS ON THE PROMOTION AND MUTUAL PROTECTION OF INVESTMENTS

MOTIVE NO. 9: PREFERENTIAL EXPORT REGIME

MOTIVE NO. 10: ACQUISITION OF REAL ESTATE IN CROATIA FROM FOREIGN CITIZENS

MOTIVE NO. 1: CLEAR LEGAL FRAMEWORK INCENTIVE FOR FOREIGN INVESTORS

Foreign investments in Croatia are regulated by the Companies Act, the Investment Promotion Act, the Act on Strategic Investment Projects of the Republic of Croatia and other laws.

The Investment Promotion Act (OG 102/15, 25/18, 114/18, 32/20, 20/21) regulates the allocation of state aid to encourage investments by legal entities or natural persons registered in the Republic of Croatia liable for payment of corporate income tax and engaged in economic activity and trade of goods and services in the Republic of Croatia.

The aid regulated by this Act relates to investment projects and strengthening competitive capability in:

- manufacturing and processing industry,

- development and innovation activities,

- business support activities

- high value-added services which simultaneously ensure environmentally safe entrepreneurial activity and one or more of the following objectives:

- introduction of new equipment and modern technologies,

- higher employment rate and better employee training,

- development of high value-added products and services,

- increasing entrepreneurial competitiveness,

- uniform regional development of the Republic of Croatia,

- economic activation of inactive assets owned by the Republic of Croatia,

- productivity growth of economic entities in the Republic of Croatia.

Investment, initial investment or investment project under the provisions of the Act is an investment in long-term assets registered as property of the beneficiary of the aid, in a minimum amount of EUR 150,000 in kuna counter value, or a minimum amount of EUR 50,000 in kuna equivalent for microentrepreneurs subject to the requirement of opening at least five new jobs related to the investment, or three for microentrepreneurs or a minimum amount of EUR 50,000 in kuna equivalent and subject to the requirement of opening at least ten new jobs for the Centres for Development of Information and Communication Systems and Software, or a minimum amount of EUR 500,000 in kuna equivalent for investment projects in modernising and increasing business process productivity.

Initial investment is an investment in tangible and intangible assets related to the establishment of a new business unit, expansion of capacity of an existing business unit, diversification of a business unit’s production to products that the business unit has not previously produced or fundamental change in the overall production process of an existing business unit.

Minimum investment for incentives:

- EUR 50,000 and opening three new jobs - micro-entrepreneurs or

- EUR 150,000 and opening five new jobs - small, medium and large entrepreneurs or

- EUR 50,000 and opening at least 10 new jobs for the Centres for Development of Information and Communication Systems and Software or

- € 500,000 for investment projects in modernising and increasing business process productivity.

The Act prescribes following incentive measures:

- tax incentives for micro-entrepreneurs

- tax incentives for small, medium and large entrepreneurs

- aid for justified costs of new jobs related to the investment project

- aid for justified training costs associated with the investment project

aid for:

- development and innovation activities

- business support activities and

- activities of high value added services

- aid for capital costs of the investment project

- aid for labour-intensive investment projects

- aid for the economic activation of inactive assets owned by the Republic of Croatia

- incentive measures for the modernisation of business processes - automation, robotisation and digitalisation of production and manufacturing processes.

MOTIVE NO. 2: CUSTOMS SYSTEM

For a business conducted between two economic operators on a single EU market to be based on free movement of goods and services, trade is conducted without customs formalities, i.e. without carrying out customs supervision of the goods and collecting customs charges.

Commodity exchanges between EU Member States and third countries are subject to common EU customs legislation, binding on all Member States, and the Common Customs Tariff. Regulation (EU) No. 952/2013 of the European Parliament and of the Council of 9th October 2013 laying down the Union Customs Code is the basic rule of EU customs policy under which legal entities and natural persons should act when importing goods from third countries or when goods are exported to third countries and who, when and how pays export or import duties and other charges.

MOTIVE NO. 3: ENTREPRENEURIAL ZONES

In its entire territory, Croatia has over 100 ready entrepreneurial zones owned by municipalities or towns, with utility services, clear ownership and good logistic and traffic connections (access to motorways, railway, ports, etc.). In addition to strong support from local communities, the possibility of additional tax reliefs (for example, relief from utility tax, lower payments for municipal services for zone users, lower land prices, depending on its size, etc.) exists for business activities within entrepreneurial zones.

MOTIVE NO. 4: TAX RELIEF

The total amount of tax incentives that the beneficiary can use when using tax incentives is determined in the absolute amount of the difference in the calculation of the amount of due corporate income (profit) tax calculated on the basis of the Profit Tax Act and the amount calculated on the basis of the Investment Promotion Act while respecting the maximum allowable amount of total aid.

Tax incentives for micro entrepreneurs

|

Minimum investment (€)

|

Number of newly employed

|

Time for creating new jobs

|

Corporate income tax rate reduction

|

Duration of incentives

|

|

50,000

|

3

|

within 3 years from the beginning of investment

|

50%

|

up to 5 years

|

Tax Incentives for small, medium and large entrepreneurs

|

Min. investment (€ million)

|

Number of newly employed

|

Corporate income tax reduction

|

Duration of incentives

|

|

>0,05 - 1 for ICT system and software development centers

|

10

|

50%

|

up to 10 years

|

|

0.15 - 1

|

5

|

50%

|

up to 10 years

|

|

1–3

|

10

|

75%

|

up to 10 years

|

|

More than 3

|

15

|

100%

|

up to 10 years

|

New vacancies have to be filled within 3 years after the start of investment.

Minimal period for maintaining investment project:

- SME – 3 years

- Large enterprises – 5 years

Incentives measures for the modernisation of business processes – automation, robotisation and digitalisation of production and manufacturing processes

This incentive measure refers only to investment projects in manufacturing and processing activities. Minimum investment required in order to become a beneficiary of this incentive measure:

- €500,000 for investment projects in modernising and increasing business process productivity

|

Min. investment

|

Differences in levels of productivity per employee after 3 years

|

Corporate income tax rate shall be reduced by

|

Duration of incentives

|

|

€0,5-1 million

|

> 10%

in relation to the level of productivity per employee in the one year period prior to the application of the investment project

|

50 %

|

up to 10 years

|

|

€1-3 million

|

75%

|

up to 10 years

|

|

> €3 million

|

100%

|

up to 10 years |

MOTIVE NO. 5: INSTRUMENTS FOR PROTECTION OF FOREIGN INVESTMENTS

The Republic of Croatia guarantees by law the same rights to foreign investors as it does to domestic investors and ensures free transfer of return on equity from the country upon completion of investment.

A foreign investor has the same rights, obligations and legal position in a company, subject to reciprocity, as a Croatian citizen or company. The Constitution of the Republic of Croatia establishes that the rights acquired by investing capital shall not be diminished by law or other legal acts and ensures free extraction of profit and invested capital from the country upon completion of investment.

MOTIVE NO. 6: DOUBLE TAXATION AVOIDANCE AGREEMENTS

The Republic of Croatia has signed over 60 treaties of avoidance of double taxation.

The complete list of countries that Croatia has double taxation avoidance contracts can be found on the web page of the Ministry of Finance - Tax Administration of the Republic of Croatia.

MOTIVE NO. 7: FREE TRADE AGREEMENTS

As the Republic of Croatia is a full member of the EU, within the framework of the Common Trade Policy, the trade relations of the EU member states with third countries are regulated by trade agreements.

By joining the EU, the possibilities of preferential exports and imports have increased significantly with regard to free trade agreements that the EU has concluded or will enter into with third countries. Imports of good of non-preferential origin from third countries shall be subject to the Common Customs Tariff of the EU.

An overview of all concluded trade agreements, the status of the agreements being negotiated and a possible search for EU trade relations with third countries and regions is available at the website of the European Commission.

An overview of the status of the agreements being negotiated is available at the web site of the European Council.

MOTIVE NO. 8: AGREEMENTS ON THE PROMOTION AND MUTUAL PROTECTION OF INVESTMENTS

The EU handles foreign direct investment policies on behalf of its members. More information about objectives of EU investment policy is available here.

MOTIVE NO. 9: PREFERENTIAL EXPORT REGIME

The EU's General Customs Preference System (GSP) is a system by which the European Union unilaterally grants trade preferences to developing countries and the least developed countries:

- lowering customs rates for developing countries when importing into the EU

abolishing customs rates for the least developed countries when importing into the EU

- Detailed information on EU General Customs Preferences is available at the website of the European Commission.

Legal entities established and registered in Croatia, regardless of whether domestic or foreign capital has been invested in them, are considered to be domestic legal entities and have the right to acquire ownership of real property. A foreign natural or legal person may acquire the right of ownership of real property, in line with the principle of reciprocity and the consent of the Ministry of Justice, according to the Act on Ownership and Other Real Rights, with the exception of citizens and legal entities from EU Member States for which there are no such restrictions.