MOTIVE NO. 1: LEGAL FRAMEWORK FOR FOREIGN INVETSMENTS

MOTIVE NO. 2: CUSTOMES INCENTIVES

MOTIVE NO. 3: FREE TRADE ZONES

MOTIVE NO. 5: ADDITIONAL INCETIVES

MOTIVE NO. 6: FDI INSURANCE INSTRUMENTS IN BiH

MOTIVE NO. 7: AGREMENTS ON AVOIDANCE OF DOUBLE TAXATION

MOTIVE NO. 8: FREE TRADE AGREMENTS

MOTIVE NO. 9: AGREMENTS ON PROMOTION AND PROTECTION OF INVETSMENT

MOTIVE NO. 10: PREFERENTIAL EXPORT REGIME

MOTIVE NO. 11: WHY INVEST IN BiH

MOTIVE NO. 12: TOP INVESTOR COUNTRIES IN BiH

MOTIVE NO. 13: AQUIARING REAL ESTATE IN BIH BY FOREIGN PERSONS

MOTIVE NO. 14: RESTRICTIONS ON FOREIGN DIRECT INVESTMENTS IN BIH

MOTIVE NO. 15: DIFERNECE BETWEEN DOMSETIC AND FOREIGN TAXPAYER TO AQUIRE REAL ESTATE

MOTIVE NO. 16: HOW TO ESTABLISH A COMPANY IN BIH

Law on the Policy of Foreign Direct Investments of BiH secure national treatment of foreign investors i.e. foreign investors has the same rights and obligation as domestic.

Law on the Policy of Foreign Direct Investments of Bosnia and Herzegovina (Official Gazette of B&H, 17/98, 13/03, 48/10 and 22/15) ensures:

Equipment of the foreign investor being imported as part of share capital is exempt from paying customs duties (with the exception of passenger vehicles, slot and gambling machines).

From the payment of import duties are exempted: production equipment that are not produced in Bosnia and Herzegovina, imported for the new or expansion of existing production, modernization of production, the introduction of new or modernization of the existing production technology, and carrying out the direct manufacturing activity

From the payment of import duties are exempted, on the production assets and other equipment belonging to the company which definitively ceases activity in another country and transfers to the customs territory of Bosnia and Herzegovina in order to carry out similar activities.

If the company that is moving is the farm, the animals on it are also exempted from import duties on importation.

In order to enjoy the benefit for foreign investor, he should submit a written request for exemption from paying import duties to the competent customs authority (according to the place of seat of the company) along with the following documents:

The Customs Office issues a decision within 15 days upon submission of the request

Free trade zones in BIH are part of the customs territory of BiH and have status of legal entity. According to the Law on Free Trade Zones of BIH, free trade zone founders may be one or more domestic and foreign legal entities or natural persons. The free zone establishment is considered economically justified if the submitted feasibility study and other evidence can prove that the value of goods exported from a free zone will exceed at least 50% of the total value of manufactured goods leaving the free zone within the period of 12 months. Currently there are four operative free trade zones in BiH.

In Federation of BIH:

Law on Corporate Income Tax enables foreign investors to enjoy the following benefits

In Republic of Srpska:

A taxpayer who invests in property, plant and equipment in the territory of the Republic of Srpska for performance of a registered manufacturing activity, shall be entitled to a tax base reduction by the value of the investment

The Register of Incentives in Republic of Srpska:

The Register of Incentives in the Republic of Srpska is an electronic database of funds for incentives of the economy of the Republic of Srpska that are allocated at national and local level, including data such as: providers and implementers of incentives, legal basis for their allocation, sources of funds, types and purposes of incentives, all the way of information about who and which amount the funds were allocated. The register is available on two portals: - Public portal of the Register of Incentives, which is available for everyone, and which contains information about the Register of Incentives, and current public calls available for interested users; - Administrative portal of the Register of Incentives, which are available to institutions and authorized persons at the level of institutions, ie for registered users. Both portals are available at www.regpodsticaja.vladars.net.

Additional incentives depend of entity and in Federation of BiH of cantons and municipality: hence, employment incentives apply, incentives for tourism sector, environment etc.

Foreign investments have same status as domestic and they enjoy the same legal and judicial protection as domestic.

Foreign investors concerned about risks of transfer restrictions, expropriation, war and civil disturbances and denial of justice, can be insured against these risks with the European Union Investment Guarantee Trust Fund for Bosnia and Herzegovina, administered by the Multilateral Investment Guarantee Agency (MIGA, member of the World Bank Group).

Bosnia and Herzegovina has Agreements on Avoidance of Double Taxation with the following countries

Albania, Algeria, Austria, Azerbaijan, Belgium, Czech Republic, Finland, France, Greece, Croatia, Holland, Iran, Ireland, Italy, Jordan, Kuwait, Qatar, China, Cyprus, Hungary, Malaysia, Macedonia, Montenegro, Moldova, Norway, Germany, Pakistan, Poland, Romania, Slovakia, Slovenia, Serbia, Spain, Sweden, Sri Lanka, Turkey, United Arab Emirates, United Kingdom and Northern Ireland.

Bosnia and Herzegovina has signed the Central European Free Trade Agreement (CEFTA), with the following countries: Albania, Serbia, Moldova, Montenegro, Macedonia.

BiH has also signed a Free Trade Agreement with Turkey which provides additional free access to this consumer market with 70 million people.

Stabilisation and Association Agreement (SAA):

The Stabilization and Association Agreement (SAA) between the EU and BiH enters into force on Jun 1, 2015. The SAA establishes a close partnership between the EU and BiH and deepens the political, economic and trade ties between the two parties. It is from now on the main framework for the relations between the EU and BiH. SAA will also contribute to the progressive alignment of BiH legislation with the EU legislation.

EFTA: Free Trade Agreement between Bosnia and Herzegovina and EFTA (Switzerland, Norway, Iceland and Liechtenstein) was signed on 24 June 2013 in Norway, and entered into force on January 2015.

Bosnia and Herzegovina has Agreements on Promotion and Protection of Investments with the following countries:

Albania, Austria, Belgium and Luxemburg, Belarus, Canada, China, Croatia, Czech Republic, Denmark, Egypt, Finland, France, Germany, Greece, Hungary, Iran, Italy, Jordan, Kuwait, Lithuania, Macedonia, Malaysia, Moldova, Netherlands, OPEC Fund, Pakistan, Portugal, Qatar, Romania, San Marino, Serbia, Slovakia, Slovenia, Spain, Switzerland, Sweden, Turkey, Ukraine, United Kingdom, USA – DFC.

BiH has generalized system of preferences with: USA, New Zealand, Japan, Australia and member states of the Eurasian Economic Union (Republic of Armenia, Republic of Belarus, Republic of Kazakhstan, Kyrgyzstan Republic and Russian Federation) Furthermore, BiH has preferential export regime with Iran.

Reputable companies with foreign capital are already operating in BiH very successfully, such as Coca Cola, Argeta, HeidelbergCement, MANN + HUMMEL, Delloite, etc., which shows that there is a climate in BiH that is conducive to success stories.

Success stories of foreign investors confirm that Bosnia and Herzegovina is favourable destination for foreign investment, and that we could be optimistic concerning the FDI inflows in the coming period. The expectation that FDI levels will be increased in Bosnia and Herzegovina, were based on on-going projects, the investment opportunities, intention of privatization many strategic companies and interest of foreign investors for potential projects. Based on data published in the Global Situation Trends Facts & Figures report in 2019, Bosnia & Herzegovina is the number 6 country globally in jobs created per 1 million inhabitants and on position 3 for export driven investment.

Unfortunately, pandemia COVID is reflecting on FDI in the world and in BiH but we expect it will change soon According to the FDI Stock by countries the largest share refers to Austria (1.4 billion EUR), Croatia (1.2 billion EUR), Serbia (1.0 billion EUR) and Slovenia (554 million EUR). In last few years’ increasement is noted of FDI from Russian Federation and from Middle East but still fist ten positions belong to European countries.

At the end of 2019, the balance of foreign direct investment amounted to KM 15.02 billion. This amount is the result of investments in previous years, as well as the operations of foreign owned companies. The largest amount of direct investments still refers to Austria (KM 2.7 billion), Croatia (KM 2.4 billion) and Serbia (close to KM 2.0 billion). Slovenia (KM 1.1 billion), Netherlands (KM 820 Million), Russia (KM 815 Million), Germany (KM 752 Million), Italy (KM 643 Million), United Kingdom (KM 815 Million), Switzerland (KM 457 Million) ), Other countries (2.7 billion KM)

Observed by activities, the highest amount of foreign direct investment was recorded in the area of financial services (KM 3.7 billion), followed by telecommunications (KM 1.7 billion) and wholesale trade (KM 1.2 billion KM).

Foreign investors have the same property rights over real estate as bh. legal entities, (when acting as companies, however when acting as natural persons the principle of reciprocity applies)

According to the Law on the Policy of Foreign Direct Investment in Bosnia and Herzegovina, foreign equity ownership of business entity engaged in the production and sale of arms, ammunition, explosives for the military use, military equipment and media shall not exceed 49% of the equity in that business entity.

In case of investing in the above-mentioned sectors, foreign investor must obtain prior approval from the competent body of the respective Entity. The Entity Government may decide, if it deems justified, that the share of foreign entity for certain enterprises engaged in the production and sale of arms, ammunition, explosives for military use, military equipment is not subject to the above restriction.

Restrictions applicable to domestic investment on account of public policy (l’order public), public health and protection of the environment are equally applied to foreign investment.

There is no difference for company owners / taxpayers (only for natural persons, in accordance with the laws on real / property rights, the principle of reciprocity applies).

To foreign investors we recommend mostly to establish limited liability company.

The Company Law of the Federation of B&H (Official Gazette of FBiH No. 81/15) and the Company Law of Republic of Srpska (Official Gazette of RS No. 127/08, 58/09,100/11, 67/13 and 100/17) regulate the establishment, operation and termination of businesses in BiH.

In Federation of BiH steps for establishing limited liability company (doo) and costs are as follows:

1.STEP - Establishment Contract (by notary)

2.STEP - Payment of initial capital

3.STEP - Registration at the competent court (municipality/district commercial court)

4.STEP - Making a company stamp

5.STEP - Opening a bank account in a commercial bank

6.STEP - Registration of the company and staff at the Tax Administration

7.STEP - The statement of the company founder about fulfilment of all requirements for starting activity (submit to the competent inspection department)

Duration and costs of establishing a business

According to the Law, the court registration procedure of establishing a business takes 5 days. And costs around 2500.00 BAM (KM)

In Republika Srpska steps for establishing limited liability company (doo) and costs are as follows

STEP 1 - Verification of the founding act by a notary

STEP 2 - Payment initial capital

STEP 3 - Registration request submit at the Intermediary Agency for IT and financial services - APIF (Agency is responsible for court registration, issuance of the tax and statistic number)

STEP 4 - Making a company stamp

STEP 5 - Open a bank account in a commercial bank

STEP 6 - Registration staff at the Tax Administration

Duration and cost of establishment of the company

The registration process with APIF takes 3 days. And costs around 500.00 BAM (KM)

|

|

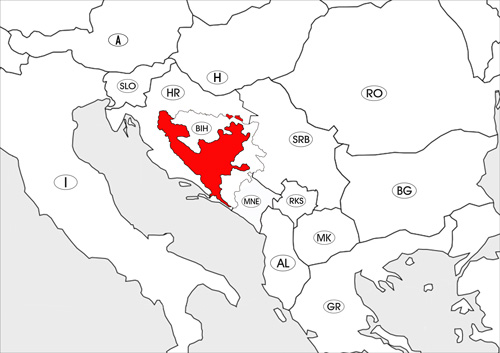

| Official languages: | Serbian, Bosnian Croatian |

| Capitalt: | Sarajevo |

| President: | Marinko Čavara |

| Prime Minister: | Fadil Novalić |

| Area: | 26.1 km² |

| Population: | 2.2 Millions (2013) |

| Currency: | KM (BAM) |

| Calling code: | +387 |