MOTIVE NO. 1: CLEAR LEGAL FRAMEWORK INCENTIVE FOR FOREIGN INVESTORS

MOTIVE NO. 2: CUSTOMS PRIVILEGES

MOTIVE NO. 6: INSTRUMENTS FOR PROTECTION OF FOREIGN INVESTMENTS IN MONTENEGRO

MOTIVE NO. 7: DOUBLE TAXATION AVOIDANCE AGREEMENTS

MOTIVE NO. 8: FREE TRADE AGREEMENTS

MOTIVE NO. 9: AGREEMENTS ON THE PROMOTION AND MUTUAL PROTECTION OF INVESTMENTS

MOTIVE NO. 10: PREFERENTIAL EXPORT REGIME

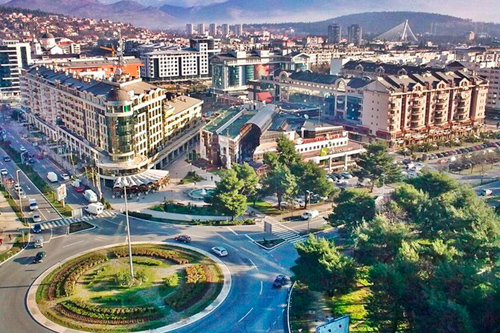

MOTIVE NO. 11: WHY INVEST IN THE REPUBLIC OF MONTENEGRO?

MOTIVE NO. 12: ACQUISITION OF REAL ESTATE IN MONTENEGRO FROM FOREIGN CITIZENS

Montenegro has enacted specific legislation outlining guarantees and safeguards for foreign investors. Montenegro has also adopted more than 20 other business-related laws, all in accordance with EU standards. The main laws that regulate foreign investment in Montenegro are: the Foreign Investment Law; the PPP law, the Enterprise Law; the Insolvency Law; the Law on Fiduciary Transfer of Property Rights; the Accounting Law; the Law on Capital and Current Transactions; the Foreign Trade Law; the Customs Law; the Law on Free Zones; the Labor Law (which is currently undergoing amendment to make personnel decisions more efficient); the Securities Law; the Concession Law, and the set of laws regulating tax policy. Montenegro has taken significant steps in both amending investment-related legislation in accordance with global standards and creating necessary institutions for attracting investments. All laws regulating the area of foreign investment are available on the Agency's website: https://mia.gov.me/regulations-legal-framework/

Pursuant to the Law on Foreign Investments of Montenegro, a foreign investor has exactly the same rights as a domestic one, ie. The law guarantees national treatment of foreign investors.

Montenegro’s Foreign Trade Law decreases the barriers for doing business and executing foreign trade transactions in accordance with WTO Agreements. You can find attached the Information on customs privileges as well as the Regulation on the conditions and procedure for exercising the right to exemption from customs duties.

Montenegro has two active free zones: the free zone Novi duvanski kombinat and the Port of Bar.

Free zone Novi duvanski kombinat (NDK) is located in Podgorica on an area of 30,229 square meters. In the area of a free zone, an investor is exempted from certain taxes and excises.

The Port of Bar Free Zone includes all terminals in the port area where cargo is transhipped and stored. The entire territory of the Port of Adria Bar (Container Terminal, General Cargo Terminal and Timber Terminal) is fully covered by the Free Zone regime. In addition to the listed specialized terminals, the development of business, production and trade activities related to import-export operations and requiring specific customs clearance and control procedures in the Free Zone operation regime is envisaged in this area.

Some of the most important benefits:

Also, in Montenegro there are business zones available, where investors can also receive incentives related to the low cost of land lease, exemption from communal land equipment, exemption from surtax on income tax, the possibility of public-private partnership and the possibility of building infrastructure in cooperation with local government. Currently, there is a public call for the use of business zones in ideal locations in Podgorica, just a few kilometers from the airport, along the Bar Belgrade railway, about 40 kilometers from the Port of Bar. The presentation and detailed public call can be downloaded here: https://www.sendspace.com/file/lax0r9

The corporate income tax rate is 9% and is one of the lowest in Europe, while the personal income tax rate is 9%. Standard VAT rate is 21%, and a reduced rate of 7% applies, among other things, to accommodation and serving of food and beverages (except coffee, alcoholic and carbonated beverages) in restaurants. The zero VAT rate applies, inter alia, to: products exported from Montenegro by the seller, ie products exported on his behalf by another person, delivery of products and services for the construction and equipping of a catering facility of five or more stars, energy facility for production of electricity with an installed capacity of more than 10 MW and capacity for the production of food products classified within sector C group 10 of the Law on Classification of Activities ("Official Gazette of Montenegro", No. 18/11), whose investment value exceeds 500,000 euros, delivery of products for free zone, free and customs warehouses and deliveries of products within the free zone, free and customs warehouses;

In economically underdeveloped municipalities in Montenegro, whose development index is below 75, the Law on Profit Tax stipulates that a newly established legal entity does not pay the calculated profit tax for the first eight years of operation. Also, by the Law on Personal Income Tax to the taxpayer, the calculated income tax for the first eight years of operation is reduced by 100%. The tax exemption does not apply to a taxpayer operating in the sector of primary production of agricultural products, transport or shipyards, fisheries and steel. These laws define the tax relief for investors, in the form of tax exemptions if their total amount does not exceed € 200,000 for the first eight years of operation.

If the amount of tax liability (output tax) in the tax period is less than the amount of input VAT, which the taxpayer can deduct in the same tax period, the difference is recognized as a tax credit for the next tax period, or returned on request within 60 days from the day of submitting the application for VAT calculation.

To a taxpayer who mainly exports products and to a taxpayer who shows a surplus of input VAT in more than three consecutive VAT calculations, the VAT difference is refunded within 30 days from the day of submitting the application for VAT calculation.

If the taxpayer has expired the deadline for payment of other taxes, the difference based on VAT is reduced by the amount of tax debt.

For new employments until the end of 2021, an employer who employs a person registered with the Employment Office of Montenegro for more than 3 months will be exempted from the obligation to pay these taxes and contributions for wages, up to the average gross salary in Montenegro in the previous year. as follows:

The Register of all incentive measures and support programs can be found in the Register on the Agency's website in Montenegrin and English: https://mia.gov.me/investment-incentive-inventory/

If you need more information about individual programs, feel free to contact us.

Montenegro provides legal safeguards against expropriation with protections codified in several laws adopted by the government. There have been no cases of expropriation of foreign investments in Montenegro. Dispute resolution is under the authority of national courts, but it can also fall under the authority of international courts if the contract so designates. Accordingly, Montenegro allows for the possibility of international arbitration. Various foreign companies have other bilateral and multilateral organizations providing risk insurance against war, expropriation, nationalization, confiscation, inconvertibility of profit and dividends, and inability to transfer currency; these are the Multilateral Investment Guarantee Agency (MIGA of the World Bank), U.S. Overseas Private Investment Corporation (OPIC), U.K. Exports Credit Guarantee Department (ECGD), Slovenia Export Corporation (SID), Italian Export Credit Agency (SACE), French Export Credit Agency (COFACE), and Austrian Export Financing Group (OEKB). In 2012, Montenegro became a party to the Convention on the Settlement of Investment Disputes between States and Nationals of Other States (the ICSID Convention). Montenegro has 23 BITs in force with the following countries: Austria, Czech Republic, Finland, Denmark, Malta, France, Germany, Poland, Greece, Netherlands, Spain, Cyprus, Lithuania, Slovakia, Romania, the Republic of Serbia, Qatar, Macedonia, Azerbaijan, the United Arab Emirates, Moldova, Israel, and Switzerland.

Montenegro has signed 46 taxation treaties with various countries on income and property, which regulate double taxation. Presently, 44 of those treaties are in force, specifically with Albania, Austria, Azerbaijan, Belarus, Belgium, Bosnia and Herzegovina, Bulgaria, China, Croatia, Cyprus, Czech Republic, Denmark, Egypt, Finland, France, Germany, Greece, Hungary, Italy, Ireland, India, Korea, Kuwait, Latvia, Macedonia, Malaysia, Moldova, Malta, Holland, Norway, Poland, Portugal, Romania, Russia, Serbia, Slovakia, Slovenia, Sri Lanka, Sweden, Switzerland, Turkey, Ukraine, United Kingdom, and the United Arab Emirates. Treaties with Spain and Qatar are pending.

On March 1, 2018, Montenegro’s Parliament approved the Foreign Account Tax Compliance Act (FATCA) agreement between the governments of Montenegro and the United States. Implementation of FATCA will help the countries better track and report tax evasion.

Montenegro signed the Central European Free Trade Agreement (CEFTA) in July 2007. The agreement has been signed by seven countries (Albania, North Macedonia, Moldova, Montenegro, UNMIK/Kosovo, Croatia, Serbia, and Bosnia and Herzegovina). A free trade agreement was signed with Turkey in 2008 and has been in force since March 2010. Montenegro had a free trade agreement with Russia. Free trade agreements with Kazakhstan and Belarus, which formed a customs union together with Russia, are also currently not in force. A free trade agreement between Montenegro and Ukraine was signed in November 2011.

A Free Trade Agreement (FTA) with the European Free Trade Association (EFTA) countries (Switzerland, Norway, Iceland, and Liechtenstein) was signed in November 2011. Although the four EFTA countries are small, they are the world leaders in several sectors vital to the global economy. Liechtenstein and Switzerland are internationally renowned financial centers and hosts to major companies and multinationals, while Iceland and Norway have highly developed fish production, metal production, and maritime transport sectors.

Investment treaties seek to ensure a stable framework for investment and better use of economic resources. They define the conditions for investments, allowing free transfer of funds, the right of subrogation, compensation in the event of expropriation and settlement of disputes between investors and countries, including the settlement of disputes between the countries themselves.

Additional information can be found at the link below: https://investmentpolicy.unctad.org/internationalinvestmentagreements/countries/140/montenegro?type=bits

The rules on preferential origin, which the goods must satisfy in order to obtain more favorable treatment, are laid down in free trade agreements.

The rules of origin for goods from countries to which Montenegro, on the basis of a unilateral decision, applies preferential customs duties are determined by a regulation issued by the Government. Where countries or groups of countries, by their unilateral decision, grant preferential customs duties on domestic goods exported to those countries or groups of countries, the rules of origin laid down in that decision shall apply.

The customs value of exported goods is the value of goods delivered to the border of Montenegro.

All domestic goods intended for export must be placed under the export procedure, with the exception of goods placed under the outward processing procedure or in transit procedure for domestic goods from one place to another in the customs territory, through another country without changing its customs status.

The Government shall prescribe the cases and more detailed conditions when no export customs declaration is submitted for goods leaving the customs territory.

The export customs declaration shall be lodged at the customs office responsible for supervising the area in which the exporter is established or resident or where the goods are packed or loaded for export.

The placing of goods under the export procedure shall be authorized provided that the goods are exported from the customs territory in the state in which they were at the time of acceptance of the export customs declaration.

Montenegro enjoys the Most-Favored Nation status with the USA. This status provides improved access to the U.S. market for goods exported from Montenegro. Montenegro has also been designated as a beneficiary developing country under the U.S. Generalized System of Preferences (GSP) program, which provides duty-free access to the U.S. market in various eligible categories, including jewelry, ores, stones, and various agricultural products.

There are many reasons why is registering a Montenegro company an excellent business opportunity. Let us check a couple of them:

There are no limitations for foreigners buying the property in Montenegro except for those limited exceptions regulated by the law (The Law on Ownership Rights):

Limitations of Foreign Persons’ Rights:

A foreign person cannot have an ownership right on:

• natural resource;

• goods in general use;

• agricultural land;

• forest and forest land;

• cultural monument of special importance;

immovable property located in the area that is, for the purpose of protection of interests and safety of the country, proclaimed by law as the area that a foreign person cannot have the ownership right on.

immovable things that is in the area of which is to protect the interests and security of the land law declared area in which a foreign person cannot have the right to property.

Exceptionally, a foreign physical person may acquire the ownership right on agricultural land, forests and forest land of a surface up to 5,000 m2, only if a residential building located on this land is subject to the contract of divestiture (sale, gift, exchange, etc.).

Knowing this, you should also be aware that a purchase of the agricultural land can be made through a company.

Buying a Property in Montenegro as an EU Citizen

The EU citizens, following the signing of the Stabilisation and Association Agreement between the European Communities and their Member States, of the one part, and the Republic of Montenegro, of the other part, have the same rights as nationals of Montenegro

Thus, the limitations from the first part are not applicable to EU citizens.

Stabilization and Association, Montenegro granted a national treatment to EU nationals acquiring real estate on its territory.

|

|

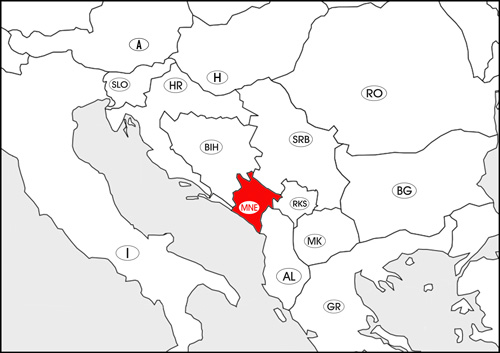

| Official languages: | Montenegrin |

| Capitalt: | Podgorica |

| Predsjednik države: | Milo Ðukanović |

| Premijer: | Dritan Abazović |

| Area: | 13.8 km² |

| Population: | 622 Thousand (2019) |

| Currency: | Euro (EUR) |

| License plate: | MNE |

| Calling code: | +382 |